|

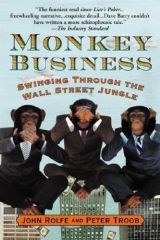

Monkey Business: Swinging Through the Wall Street Jungle (平装)

by John Rolfe, Peter Troob

| Category:

Wall Street, Finance, Stock market, Speculation |

| Market price: ¥ 168.00

MSL price:

¥ 158.00

[ Shop incentives ]

|

| Stock:

Pre-order item, lead time 3-7 weeks upon payment [ COD term does not apply to pre-order items ] |

MSL rating:

Good for Gifts Good for Gifts |

| MSL Pointer Review:

Sad but true memories for those who've been there and done that, this book is a must read before you consider a career in Investment Banking. |

| If you want us to help you with the right titles you're looking for, or to make reading recommendations based on your needs, please contact our consultants. |

|

| |

AllReviews |

1 2 Total 2 pages 13 items 1 2 Total 2 pages 13 items |

|

|

A reader, USA

<2006-12-24 00:00>

Five big stars, and props to the banking clowns who wrote this beauty. I read this in a night and loved it. My wife then picked it up and read it the next night. She loved it too. Monkey Business managed to be funny, informative, and engaging in a way that few business books ever are. This is what Liar's Poker should have been. A few words of warning. The authors can be harsh. They do so in a non-discriminatory fashion and spend more time brutalizing themselves than others, but the easily offended may want to stay away. Second, if you're a fat happy banker with no sense of humor, you're going to hate this book. You'll feel like you're in a cage, and you're being poked in the eye with a long, hot stick. Lastly, if you have ANY vested interest in suppressing the truth regarding the ludicrous games that get played on the Street then you'll want to steer clear. For the rest of us mortals, you'll love it. |

|

|

Donald Mitchell, USA

<2006-12-24 00:00>

Before going into my review, let me start with a caution. This book is the grossest, most vulgar business book I have ever read . . . by a very wide margin. This book would have been banned in Boston 50 years ago. If that sort of thing offends you, this book is a minus ten stars. Many women will feel this book is anti-female. On the other hand, if you happen to like your humor male, bold and brassy, this book will be one of the funniest you will ever read.

As someone who often works with investment bankers, the descriptions about how business is sold and delivered should be tempered a bit. This book describes pretty much every investment banker as shoddy, shallow, and manipulative. That has not been my typical experience. There are terrifically smart, talented, ethical and humane investment bankers. For example, one of my favorites never used a pitch book during his first meeting with a client. Pitch book preparation is one of the banes of the young investment banker's existence. But like all professions, investment bankers vary a lot. There are certainly some less capable ones, and I have seen their work too. I would describe it much like the authors do.

In terms of the working conditions, they are mostly a reflection of weak management in the industry. Investment banks reward doing deals, not being good managers of the deals. A fellow I know became CEO of a major investment bank, and made much less money after that than when he was just a deal-maker. He found little interest on the part of his colleagues in improving management, so it was pretty frustrating. It just doesn't pay to work on making life better for the investment bankers in training, compared to producing more business.

The book's main point is that many young people enter investment banking without knowing what it is like, and are overly impressed with the financial prospects. If your values really favor having time for yourself, your family, and developing your other interests, this is probably the wrong career for you. There are plenty of other ways to make lots of money. The richest people I know are entrepreneurs, not investment bankers.

The book's other main point is that you should take a look at close yourself before you compromise too many of your values. The authors should have never joined an investment bank. Having done so, they should have left much sooner.

CEOs and CFOs should read this book also, to know what to check out carefully in the work that investment bankers do. Most companies now develop their own ideas, and just hire the investment bankers for implementation. In that role, fewer problems will occur of the sort described here. Perhaps the most dangerous role is having an investment banker help you select and pursue an acquisition. Many expensive mistakes follow under those circumstances. Caveat emptor!

You will probably find the monkey drawings in the book add to the humor. The text frequently refers to monkey-see, monkey-do type examples, and the whole story is seen more usefully as a bunch of monkeys playing in a gilded cage. That takes some of the sting out of the gratuitous grossness.

If you liked the put-downs of investment bankers in Liar's Poker, this book will be irresistible to you.

After you have had a good laugh, take a look at your current job and see how well it fits your values and life goals. Chances are that it doesn't. Be prepared to figure that out, and move onward and upward out of whatever gilded (or not-so-gilded) cage you are in today into the freedom of self-actualization.

|

|

|

Tom, USA

<2006-12-24 00:00>

Having had the pleasure of working with investment bankers from several firms recently, this person was looking forward to learning more about what these guys have to go through. Sure, the hours are tough and long, and the perks are even more tremendous than anyone could imagine. But go figure, to succeed in any high powered profession, there is a period of ungodly work hours required, and a true dedication to be successful. Go ask any physician, who has to work harder in the early parts of a career than any banker. The authors prove what anyone who has been through a successful career chase knows, to be able to persevere and be successful at something, you have to enjoy doing what you are doing. The system has a way of weeding out those who are only in it for the money, and it worked fine here. Rolfe and Troob are opposites in many respects, but brought together by a disdain for a career path they had chosen - and chosen only to get rich. Troob on the one hand, decides that life has more to offer than the commitment to a successful career in investment banking would allow. He comes across as decent, bright and able to be successful at lots of things. Misery loves company, and Rolfe is the loser who even after leaving DLJ can't make it in a job. He tells how he got in through good fortune, and appears to detest every thing he was doing. Now let me see, I get a job, but I can't stand the work, and I hate it, therefore the system must be terrible that this career that pays so well isn't fun for me. Jealous of those who are successful in a career where he doesn't belong, he tries to blame the system for creating the scumbag that he is, and take it down with him on his spiral to nowhere. The American dream has warped to the desire to be financially successful without having to pay the price. The instant riches of Lotto drawings and the drive-through McDonalds mentality of financial expectations are alive and well in Rolfe. By writing the trash called Monkey Business and wrapping it in the glamour of Wall Street, Rolfe and Troob give a powerful example of just how easy the warped American Dream can be.

(A negative review. MSL remarks.) |

|

|

|

1 2 Total 2 pages 13 items 1 2 Total 2 pages 13 items |

|

|

|

|

|

|