|

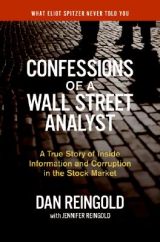

Confessions of a Wall Street Analyst : A True Story of Inside Information and Corruption in the Stock Market (精装)

by Daniel Reingold, Jennifer Reingold

| Category:

Wall Street, Stock market, Telecom sector, M & A |

| Market price: ¥ 268.00

MSL price:

¥ 248.00

[ Shop incentives ]

|

| Stock:

Pre-order item, lead time 3-7 weeks upon payment [ COD term does not apply to pre-order items ] |

MSL rating:

Good for Gifts Good for Gifts |

| MSL Pointer Review:

A compelling and entertaining account of the boom and bust in telecom as seen by a top analyst, this book is good to gain insight into how the Wall Street works. |

| If you want us to help you with the right titles you're looking for, or to make reading recommendations based on your needs, please contact our consultants. |

|

| |

AllReviews |

1 Total 1 pages 10 items |

|

|

David Faber (Anchor, CNBC TV) (MSL quote), USA

<2006-12-25 00:00>

A coming-of-age story in an age Wall Street would like to forget. In this riveting memoir, Reingold takes us for an exhilarating ride through the dark alleys of Wall Street and reminds us that in the world of finance, one thing remain constant: Caveat Emptor, Buyer Be Aware. |

|

|

Michael K. Powell (Former Chairman of Federal Communications Commission)(MSL quote), USA

<2006-12-25 00:00>

Every rocket needs fuel, but Dan Reingold shows us that much of what propelled meteoric rise of the stock market in the late 90s was self-interested, sometimes even criminal, hot air. This book is a riveting and appealing account about the people and events that changed Wall Street and the telecommunications landscape forever. |

|

|

John C. Coffee (Adolf A. Berle Professor of Law, Columbia Law School) (MSL quote), USA

<2006-12-25 00:00>

Dan Reingold’s behind-the-scenes account of life as a securities analyst as the stock market bubble of 2000 grew and burst has all the ingredients of a fictional bestseller: heroes and villains, greed, arrogance, and stupidity - and rampant conflicts of interest. But it is not fiction, and it is not the story of a bygone world. The problems and conflicts he reveals remain acute today, even after recent reforms. Read this book before you rely on any investment advisor. |

|

|

Eric Hemel (Former Co-Director of U.S. Equity Research, Merrill Lynch), USA

<2006-12-25 00:00>

This book captures an Shakespearean struggle of an all-star Wall Street analyst who strove to perform his role ethically, while pressured intensely to “play the game” and promote the stocks of his firm’s clients. Decades from now, economic historians will turn to Confessions of a Wall Street Analyst for a complete understanding of the 90s’ stock market bubble. |

|

|

Library Journal (MSL quote), USA

<2006-12-25 00:00>

One of the top research analysts in the country, Dan Reingold (project director, Telecom Finance, Inst. for Tele-Information, Columbia Business Sch.) was employed by Wall Street firms Morgan Stanley, Merrill Lynch, and Credit Suisse First Boston from 1989 to 2003. Now, with Jennifer Reingold (Fast Company magazine; coauthor, with Barbara Ley Toffler, Final Accounting: Ambition, Greed, and the Fall of Arthur Andersen), he takes a probing look back at the burgeoning telecom industry of that period, during which he was earning more money than he ever dreamed possible. It's a terrific memoir filled with funny anecdotes and sagas of unethical behavior and staggering corporate losses. The cast of characters includes Bernie Ebbers, Frank Quattrone, and Jack Grubman, who all soared through the Wall Street sky only to crash and burn. While there have been other recent Wall Street insider accounts of the rarified lives of analysts, notably Andy Kessler's Wall Street Meat, Reingold is especially knowledgeable about the nuts and bolts of being a research analyst, as well as the "telecom bubble" and his role in it. His closing suggestions on how best to reform the practice of research analysis on Wall Street bears closer scrutiny; his claims that the regulators (notably the SEC) were basically asleep at the wheel, allowing criminal activity to happen, is damning. This honest and irreverent behind-the-scenes account of life on Wall Street is highly recommended for public libraries and larger business collections. |

|

|

A reader (MSL quote), USA

<2006-12-25 00:00>

I highly recommend this book. It achieves with great success the winning formula for quality non-fiction - an exciting true story told in a very readable way. It is truly a page-turner. The fact that the subject matter, including details of finance and securities, is unfamiliar to non-Wall Street types, makes the story-like atmosphere all the more impressive. You definitely feel as though you’ve joined an insider on a wild, wild ride. The tale of the rise of telecom within the stock market boom of the late ‘90s is one of amazing twists and turns, crazy personalities and of course, ultimately, a crash as startling as the rise itself. There are many detailed scenes and memorable images, notably of various meetings with the biggest of Wall Street’s big shots, that are truly too bizarre to believe. I followed much of what went on in telecom and Wall Street in general as it happened, but having now read this book, I feel I have a real understanding of what went on on the inside, and I can't believe how truly amazed I am - the depth of it all went beyond even my most cynical view. The author, Dan Reingold, does an amazing job of relating his personal experiences while weaving them into the overall theme. He is clearly Derek Jeter to Jack Grubman's Barry Bonds. I imagine that he may receive criticism from people (likely those still working on Wall Street) who feel the picture presented is too negative or who question his motives (though he has noted that all proceeds are being contributed to charity). But I think it is clear - he told the story as he saw it and lived it - nothing more. There were even many instances in which he admitted bad decisions (or indecisions) and regrets. But the motive seems clear to me - it was an important, relevant story that should be told, hasn't been fully told, and is of interest and importance to many. He had a front row seat and was in a unique position to tell it. And as a reader, I couldn’t put the book down. |

|

|

R. Spell (MSL quote), USA

<2006-12-25 00:00>

I've read many books on the inter-workings of Wall Street. I work at a regional investment banking firm and took a considerable loss in Worldcom preferred stock which gives me added perspective. While much of this has been reported in the Wall Street Journal, overlaying Reingold's rise from an MCI financial analyst to the leading Wall Street analyst of telecom stocks, provides great insight to working on Wall Street and the pressures during the 90s bull market. Having worked with Frank Quattrone as well as covering all the telecom executives, Reingold weaves a story of stock manipulation and inside information use. Some people seem to be put off by his running feud with Jack Grubman which occupies so much of the book. They both covered telecoms but from completely different perspectives. His blow by blow account of his view of companies and Jack's, as well as Jack's dubious ability to get information first, is the most enjoyable part of the book. I strongly recommend this book to learn of Wall Street dark side and revisit the 90s bull market. |

|

|

A reader (MSL quote), USA

<2006-12-25 00:00>

I highly recommend this book. It achieves with great success the winning formula for quality non-fiction - an exciting true story told in a very readable way. It is truly a page-turner. The fact that the subject matter, including details of finance and securities, is unfamiliar to non-Wall Street types, makes the story-like atmosphere all the more impressive. You definitely feel as though you've joined an insider on a wild, wild ride. The tale of the rise of telecom within the stock market boom of the late `90s is one of amazing twists and turns, crazy personalities and of course, ultimately, a crash as startling as the rise itself. There are many detailed scenes and memorable images, notably of various meetings with the biggest of Wall Street's big shots, that are truly too bizarre to believe. I followed much of what went on in telecom and Wall Street in general as it happened, but having now read this book, I feel I have a real understanding of what went on on the inside, and I can't believe how truly amazed I am - the depth of it all went beyond even my most cynical view. The author, Dan Reingold, does an amazing job of relating his personal experiences while weaving them into the overall theme. He is clearly Derek Jeter to Jack Grubman's Barry Bonds. I imagine that he may receive criticism from people (likely those still working on Wall Street) who feel the picture presented is too negative or who question his motives (though he has noted that all proceeds are being contributed to charity). But I think it is clear - he told the story as he saw it and lived it -- nothing more. There were even many instances in which he admitted bad decisions (or indecisions) and regrets. But the motive seems clear to me - it was an important, relevant story that should be told, hasn't been fully told, and is of interest and importance to many. He had a front row seat and was in a unique position to tell it. And as a reader, I couldn't put the book down. |

|

|

Paul Allaer (MSL quote), USA

<2006-12-25 00:00>

Dan Reingold was a telecom industry analyst from 1989 to 2003 for some of the top Wall Street investment banks (in turn, Morgan Stanley, Merrill Lynch, and Credit Suisse First Bank) and thus had a first hand (if not insider) look at the amazing run of the bull-market in the 90s, only to see it come crashing down.

In Confessions of a Wall Street Analyst, the author gives a fascinating first-person account of the workings of Wall Street investment banks analysts. The best part of the book for me is the first half, in which Reingold describes his humble beginnings at MCI, only to be recruited to Morgan Stanley to give his analysis and recommendations to investors at what turns out to be the best possible time (some years before the bull-market started its seemingly never-ending run). Major issues that come up time and again are the inherent conflicts between the investment bankers and the analysts working for the same firm, and the incomprehensible lack of SEC action to do anything about it, in fact aggrevating at times the situation (when the SEC went to the "No-Action" letter practice). I don't understand Reingold's seeming never-ending rivalry and fascination with his No.1 analyst competitor Jack Grubman (who eventually gets nailed for using insider information). The other thing that stuck me is that these guys don't have a life. I mean, I work hard (or so I think), but guys like Reingold and others in Wall Street work 24/7 it seems.

Being a lawyer, but in no way connected to Wall Street, I really enjoyed Reingold's book, for many reasons. It's now going on 6 years since the bubble burst, and it's still hard to phantom all that went on in the crazy days of the late 90s, and how WorldCom and others were able to completely fool and defraud everyone around them. Highly recommended! |

|

|

Craig Matteson (MSL quote), USA

<2006-12-25 00:00>

I always find the inside stories of events as told by the participants very interesting. If they are candid, and that is a big if, they can provide information and perspectives on events and people that can't be had from those of us on the sidelines. The problem with these accounts is that any participant only knows what he or she did and those pretty much in their immediate vicinity. To get things in a larger context is often beyond their expertise and so their opinion on the big picture is often as distorted and incomplete as anyone else's guess. Then there is the self-interest bias that prevents most people from presenting and completely open picture of themselves and to load up to heavily on why the other guy is the real bum.

Well, this is a terrific book and I enjoyed reading it very much. Honestly, I picked it up with some trepidation for the reasons I list above. Dan Reingold tells his own story as one of the very top telecom analysts on Wall Street. He provides a very interesting and honest context for his entry and rapid rise and is quite clear about the lavish pay scales and pressures his job enjoyed and endured. He is quite open about his own experiences in moving up the ladder and from firm to firm (always at higher pay and better terms). I very much enjoyed the way he describes how these negotiations are handled.

The most interesting part of the book, for me, was his discussion of the inherent conflicts between the analysts and the banking side of the firm. For the most part, Reingold managed these conflicts well and honorably. This approach to his job not only earns our respect, but kept him from being caught up in the scandals that took down so many in his industry, especially the notorious Jack Grubman. It is Grubman who is Reingold's nemesis and the reader will find himself as frustrated as the author when Grubman seemingly clearly violates not only the rules of an analyst's job, but the law and yet nothing happens. It seems that as long as the Bull Market is on, no one wants to risk upsetting the situation, but when things collapse, someone must be blamed and the most egregious violators are called to task. However, Reingold is clear how so much of the focus of the hearings was misplaced and the actual bad behavior, the insider trading, was not pursued.

The author shares with us what every Road Warrior knows, that the glamour of the life on the road is much more apparent than real. The difference is the Reingold earned millions of dollars, and enjoyed (for the most part) the very finest accommodations available. However, when one travels a lot, it is often hard to remember exactly where one is when one first wakes up. I learned to tell what country I was in by the ring of the phone, however, one time I was in my own bed and heard the phone ring after being away for weeks, and couldn't quite place the ring even though it seemed like I should remember it. However, I never traveled half way around the world for a half-day meeting. That is a level of travel I hope to never know.

If there is a central theme to the book, it is WorldCom, Bernie Ebbers, Scott Sullivan and Jack Grubman. Gary Winnick and Joe Nacchio are secondary characters to add color and depth to the story. Frank Quattrone is just a bit player in this telling of the story (not that his role in the boom - bust was small). The author takes us from the story of the napkin and the founding of LDDS through the amazing rise of the company. When the bubble finally breaks we also get to see terrible crash of the company and the eventual sentencing of its principle officers. Grubman ends up vilified and becomes one of the faces and names the public associates with the corporate fraud of nineties boom.

Reingold does ask himself why he didn't dig deeper into WorldCom's finances. He says that it never occurred to him or anyone else that they would ever commit a fraud so brazen. Given the millions these analysts receive and the millions more the firms spend on their staff, I would hope that from now on they have a forensic accountant or two digging more deeply into the structure and financials of the companies they tout. I know that it is not in their financial interest to do so, but given what we went through recently, it might be in their long term interest to throw a few penalty flags so the public can have a bit of faith in their integrity (did I hear someone cough and choke?).

In the epilogue, the author gives us a "where are they now" update and in the afterword he takes us through his analysis of the reforms that came out of Spitzer's prosecutions (mostly useless) and his own recommendations of what should (but won't) be done. In the end, he rightly notes, that liars will be liars and crooks will be crooks. There is no replacement for integrity and no regulation that can control the dishonest.

He leaves the reader with a point he hopes everyone takes away from this book. It is that the information flows are so biased in favor of the insiders and highly placed professionals that the individual has no real reason to buy anything but indexes or broadly based mutual funds. For individuals to be buying individual stocks, they simply must accept that they are stepping into an unfair game that is set up against them.

A very good read for anyone interested in Wall Street, business finance, and investing. |

|

|

|

1 Total 1 pages 10 items |

|

|

|

|

|

|