|

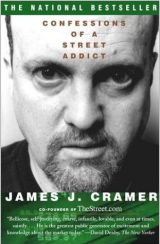

Confessions of a Street Addict (平装)

by James J. Cramer

| Category:

Hedge fund, Wall Street, Investment banking, Stock market |

| Market price: ¥ 158.00

MSL price:

¥ 148.00

[ Shop incentives ]

|

| Stock:

Pre-order item, lead time 3-7 weeks upon payment [ COD term does not apply to pre-order items ] |

MSL rating:

Good for Gifts Good for Gifts |

| MSL Pointer Review:

Compelling, personal and obviously belonging to the same league as Liar's Poker, this book is easily one of the best about the Wall Street. |

| If you want us to help you with the right titles you're looking for, or to make reading recommendations based on your needs, please contact our consultants. |

|

| |

AllReviews |

1 Total 1 pages 10 items |

|

|

Karen Corn (MSL quote), USA

<2006-12-25 00:00>

My husband and I took turns reading this book aloud to each other, which meant we spent basically a day in front of a roaring fireplace, snowed in and riveted by the memoirs of a guy who defied normal human behavior.

First off, how many kids start off in life fascinated by the financial section of the newspaper, let alone making pretty shrewd jusdgments of which stocks would be wise investments? How many try to get their fellow students to play "the stock market game" (he didn't succeed in getting them to do so in spite of his game attempts). How many grow up and get a Harvard law degree and chuck it to work on Wall Street, grueling by most people's standards, high stress, high risk, etc?

What struck me about this book were several things:

1. Cramer is a far different person within the confines of a book than he may appear on tv. Yeah, he admits to craxy behavior, workaholism, talking business while on vacation and even during the delivery of one child...but at least he isn't there shouting and sweating and leaving the impression he is about to have a heart attack, right there, on air. Yes, he admits to having tantrums, trashing keyboards, throwing bottled water at people, etc. But hey, he is at least admitting this!

2. His wife is the woman behind hin and perhaps the major reason for his success, since she pulled him out of a major tailspin..according to his account. Either he is a very savvy husband or he is wise enough to give credit where it is due.

3. He finally wakes up and realizes the costs of his behavior, after alienating a good friend (they make peace afterwards), talking business during a funeral, etc.

If you are buying this book to learn the details of trading and Cramer's "method" you'll have to read between the lines. But this didn't matter to us. Take one excellent writer, some superb anecdotes, tons of humor and some moments that give a whole new meaning to the words "risk tolerance"...and you have a wonderful book, perfect for even those who think they'd never want to read about a guy in the financial/ hedge fund business.

And yes, we have started perusing the financial sections of the papers more closely. So there's that, too. |

|

|

G. Shikodra (MSL quote), Canada

<2006-12-25 00:00>

I'm not mad about Jim Cramer and I guess I'll never be. His brash, arrogant, loudmouth way of commenting on different business or even political issues on tv, whether it's on "Mad money", "Kudlow and Cramer", "Squawk Box", "Good morning, America" or any other television show he's ever been on can get on my nerves sometimes. As a matter of fact, it's not so much his comments rather than his behaviour, his body language and his way of making a point that grate on me.

But he is one of the very few investors/traders that I have ever heard say "I was wrong about this stock or this company, and I don't have any problems admitting it", and I give him credit for that. The guy seems, if not honest, at least sincere to me. And I guess brashness, arrogance, sincerity, his loud mouth and the fact that he craves public attention make of Jim Cramer a highly colourful, flamboyant character. I'm always interested in what he has to say, even if I don't agree with him: sometimes, when he's on tv, the guy can be downright funny in his own way!

And so, not very enthusiastically I picked up this book and began reading it on a rainy weekend. Contrary to some of the readers who have posted reviews here at Amazon.com, I didn't really expect to learn any valuable trading methods or technical stuff, since the book's title is "Confessions" and not "Methods". No, as a matter of fact, when I think about it, I did learn something original. Cramer's idea of visiting department stores to find the next big thing and asking the right questions to the store clerks was very amusing to me.

This turned out to be a very honest, sincere and interesting book indeed. I was amazed by a few things in particular though:

1-Dedication, hard work and brains do pay in life. But that's not always enough. Sometimes you have to be lucky too. And Cramer was lucky, and he still is. His luck is called Karen Backfisch, and he is honest and humble enough to admit it. I mean, how many times did she bail the guy out? Reading the "Crisis in 1998" chapter, I almost felt I personally lived every infinitesimal instant of that crazy October 8, 1998 with Mr Cramer. Where would he be now, had the trading goddess not returned to the desk just for that day? "Hey, chum, looking glum!"... Sometimes all you need is a divine intervention.

2-I would have never thought a guy so successful in making money for himself and others could be so naive and blind as a bat in his relationships with business partners or close friends. That Ravi Desai story is quite revealing in this regard. It lead to Cramer's falling out with the guy who started it all for him, Marty Perez, and that too is unbelievable. Once again, his wife seemed to understand relationships and sense betrayal and disloyalty much better than he did.

3-I simply couldn't believe how unhappy and miserable this man was. I mean the guy almost had no life, he was constantly yelling and screaming, smashing cell phones and keyboards, calling people names; he misses his sister's marriage and talks about call positions on the phone while his mother lies dead in front of him...How miserable can you be? I think Howard Kurtz resumes it very well in his book: "It's amazing that a man so wealthy and successful can still be so manic and miserable!"

4-Again, I wasn't disappointed by the lack of trading methods or technical issues in this book. One little remark though: I thought cutting your losses short and being ok with some losses from time to time were "generally accepted trading principles" in the trading/speculating/investing world. Well, oddly enough, these two don't seem to be Cramer's principles. The guy takes losses personally, small and big ones, and he seems driven by emotions almost all the time. I thought that was something every trader tries to avoid. But then again, I guess that's ok. Mr Cramer has made millions over the years, so he must have had a bunch of other golden rules.

Many people couldn't wait (and I guess they still can't) to see Jim Cramer go to jail. Good Lord, people, you only have to blame yourself if you did poorly in the market during the last years. Cramer was pumping stocks he owned on various shows? He wrote "it's time to dump everything" in his recent column? He said he loved this company and hated that other stock during his last appearance on tv? So what, quit listening to him and start thinking independently! What do you think the analysts at Goldman, Merrill, Fidelity or Schwab have been doing over the years? Their buy/hold/sell recommandations can move the market, but sometimes the stocks don't go in the direction they expected or predicted them to go. Should they go to jail too? |

|

|

Tom Mongle (MSL quote), USA

<2006-12-25 00:00>

James J. Cramer (Cramer & Berkowitz, TheStreet.com, CNBC's Kudlow & Cramer) takes you to a stock market trader's hell and back in "Confessions of a Street Addict." The analogy of investing being a war zone was coined at least 70 years ago with Gerald Loeb's "The Battle For Investment Survival" (1935). And you can't make it through the pages of this book without realizing what a battlefield it is. No book comes closer to approximating the giddy highs or heart-wrenching lows that trading puts a person through. The glory of victory and the agony of defeat are never more real as Cramer bares the trader's soul.

The book reads almost like an adventure novel - ricocheting from one crisis to another, each scene set up with hero and villain, with Cramer not always coming out on top. He starts you off with his basic biography, of being a teenage stock picker (paper trader), of his march through journalism (which shows in his writing), of Harvard Law, and eventually to Wall Street's most intense stage of conflict - the hedge fund.

The beauty of this book is that you get the fly-in-the-brain's view of how traders think (or don't think when their emotions get the best of them), how Wall Street really works, and how it all congeals together to produce the daily statistics. You are there as Cramer learns the ropes from his wife-to-be, The Trading Goddess, Karen Backfish. You sweat with him as he does deals, takes chances, high-fives victories, and crashes so low with failures he could probably seep out under the door unnoticed. A lot of the things you learn run counter to what the official Wall Street line wants you to know - the inside story of the blow-up of LTCM, and how analysts, brokers, and fund managers continually jostle each other for positions of power and influence, and profit.

The most interesting part of the book is being there as the Internet springs to life in the mid 90s - the wild enthusiasm and the unbelievable cluelessness that much of the Internet was built upon. But it was built, and it was built by the types of people Cramer came in contact with regularly - half geniuses, half dreamers, and half con men. And you're right - most of the time, it didn't add up.

Cramer, in addition to being a market manic, had a populist's belief that the little guys should have the same access to what the big guys had, and that the technology was now here to make it possible. TheStreet.com was the result. It's still here - one of the survivors, as is Cramer.

A lot of the book is a sad commentary on how far an addiction can twist your life around. Cramer chastises himself for talking stocks beside his mother's deathbed, his tumultuous relationship with his benefactor Marty Peretz, the destruction of computers and equipment and abuse of employees when the market went against him, and how he deserted his family for the sake of "the game." He simply couldn't stand to lose. In the end, he had enough common sense (though he makes it clear that his wife was always the steady rock in their relationship) to quit while he was ahead.

I particularly enjoyed Cramer's honesty at the extremes, (the emotional soul-wrenching limit) especially the bottom in 1998 (when he caved in - "sell everything, the market's gonna' crash - it's the end of the world"), and at the top in 2000 (when he publicly announced Internet stocks would live forever), and Cramer's final tantrum with the market on 22 Nov 00 when he met his match in a long Brocade position (I quit!). Each time, Cramer was so sure he was right, nobody or thing could dissuade him of his fallibility. But each time, it was his wife (1998), or reality (2000), or, finally, his own cathartic understanding of himself that led him back to humility... and humanity.

Given his personality, one must believe that if he had taken up stamp collecting, little would have changed, and it would be the philatelic world which would have had to live through Cramer's manias. Summing up his career, Cramer quotes his wife's 1998 pronouncement as they recovered from nearly panicking out at the bottom: "It's better to be lucky than to be good." However, with the success Backfish and Cramer had, I expect their luck was more of the variety of being smart enough to be at the right place at the right time than that of a pure roll of the dice. Good traders aren't just lucky, they're good. And Cramer was good, even if he was an addict.

|

|

|

James Garrett (MSL quote), USA

<2006-12-25 00:00>

James J. Cramer, opinionated and bellicose founder of the Street.com and hedge fund manager distills his fire-breathing personality and stock-market enthusiasm and serves it up in this riveting and compulsively readable tell-all of Cramer's life and times on Wall Street.

Cramer rips through his early life as a young Pennsylvania kid fascinated with stocks, zips through his years as an undergrad and burgeoning journalist at Harvard, shoots through his days as a rookie reporter at the L. A. Herald Examiner and his nights sleeping in a battered Ford Fairmont - and by page 14, we're already knee-deep in Cramer's passion, the stock market.

Cramer writes engagingly and keeps up a roaring pace, and reading his material is like being ensconced inside the guy's feverish, always calculating head. It's about as close as most will come to having a seat at a hedge-fund trading desk, and whether you're just interested in the Market or have years of experience, you'll find Confessions a tasty and addicting read.

The writing is amazingly candid, and the most refreshing thing about "Confessions", apart from the fact that it's rippingly good fun and fine writing, is Cramer's honesty. For all his bluster and arrogance, and for all his consumptive attention to outperforming the indexes and his rivals (and for better than 13 years, his hedge fund Cramer Berkowitz did just that) Cramer is willing to accept the lion's share of the blame here. Who threw bottled water and telephones at the heads of his henchmen on bad trading days? Who pancicked and wrote a capitulatory "get out NOW!" article on TheStreet.com on October 8th, 1998, just as the worst had occurred and the markets were beginning the roaring rally that would not end until 2000? Who, surprisingly, had abolutely no clue what was going on in the company he had poured his name and his money into, and didn't have any kind of feel for the circus of the coming IPO?

Cramer, Cramer, and Cramer. There are really three Jim Cramers in "Confessions": Cramer the trader, Cramer the stock-market commentator and journalist, and Cramer the dot-com businessman and New Economy darling. Guess which "Cramer" gets him in the most trouble?

But let's cut to the chase: Confessions of a Street Addict is loads of fun and a wild perch to look out on what has been a real revolution in the financial markets; Cramer's honesty, experience, wide-ranging connections and candor make this the funniest and most introspective book on Wall Street since Mike Lewis wrote "Liar's Poker" - and hey, Lewis even has a cameo role in Confessions, in which he's credited with coming up with the name "TheStreet" for the company that became TheStreet.com.

That's just one character in a roster that looks like Who's Who of Wall Street, 1982-2003: Cramer meets up, socializes, trades and schemes with Robert Rubin, Roger Ailes, Joe "The Big Kahuna" Kernan, David "The Brain" Faber, and Mark Haynes.

He crosses swords with Barron's Alan Abelson and Money's Frank Lalli, and engages in the time-honored Wall Street passtime of making fun of the corrupt Dan Dorfmann. During his Harvard Law years, he works as a research grunt for high-powered defense attorney Alan Dershowitz, putting together briefs on the Klaus von Bulow case (and, apparently, played by "some Indian guy" in the movie "Reversal of Fortune"). He gets interviewed by Oliver Stone's research henchmen when he's a salesman at Goldman Sachs, and, according to Cramer, serves as Stone's inspiration for getting Buddy Fox in to meet Gordon Gekko in "Wall Street". He even opens his uber-restrictive hedge fund up for redemptions when a major client, Elliot Spitzer (then running for Attorney General of New York), asks to withdraw some funds to fuel his campaign, and suffers a nearly disastrous run on the fund that almost swamped him.

But the real attraction of "Confessions" is the way Cramer weaves his life and career into the seminal events that have defined modern Wall Street and moved us through a financial revolution, and we get a trench-level tour of the really seismic events: the 1987 Black Monday crash, buying into the 1991 Iraqi war, the implosion of Long Term Capital Management, the Asian Contagion and Russian collapse that nearly ended a 16-year old Bull Market, and the stock bubble that defined the twilight years of the "New" Economy.

Having read Confessions, I thank God for a man like Jim Cramer: it shows me our hard-charging capitalist system is still working if it can produce a man like him. Cramer's chief virtue is that he says what's on his mind, an attribute, noble as it is, that got him in trouble in the SmartMoney event that he chronicles. In a way, Cramer is like Wall Street's answer to G. Gordon Liddy, a man who says and does what he pleases, and damn the torpedoes.

And Cramer is, was, and always will be a tireless and funny stock promoter, and his enthusiasm is infectious: if you aren't already gunning for equities and watching that ticker, you will be after you read this book - just be careful to take the lessons herein to heart.

Confessions of a Street Addict is a high-octane shot of raw adrenaline and compulsively addicting, and provides a 20 year ride inside the mind of a premier hedge fund manager - for that alone, it's worth the price of admission.

|

|

|

Charles Miller (MSL quote), USA

<2006-12-25 00:00>

This is really three books rolled into one. First, a Horatio Alger story of the boy from Philadelphia who rises to the top of Wall Street. Second, an inside story of what it was like to found a dotcom during the internet bubble. And third, an account of how the stress of running a hedge fund drove an otherwise decent guy to be a real Mr. Hyde. Amazingly, the book works on all three levels.

On the first count, Cramer shows that hard work and monomaniacal interests can take a person to Harvard, to running the Harvard Crimson, to sleeping in one's car, to being a top producer at Goldman Sachs, and to founding a money-minting hedge fund. This Cramer is clearly the most likeable, and is nice to know about as you watch him with Larry Kudlow.

Cramer the entrepreneur is fascinating on multiple levels. As he recounts his adventures with VC's and recruited management, he displays a naivete that is truly jaw dropping. I have been involved with a number of VC-funded start-ups, and I always thought that Wall Street types like Cramer understood how the game is played. The fact that he was so befuddled by it helps to explain how the internet bubble fooled so many of his colleagues.

Finally, there is Cramer the hedge fund manager. Cramer became so enraptured with this role that he let everything else in his life go-from simple courtesy to friendships to his family. If Cramer was even half as nasty as he describes, his wife must be one of the saintliest women of our era to put up with him. The fact that he recognized what was happening to him and walked away while at the top of his game, before dropping dead of a stress-induced coronary, puts the icing on the Cramer cake.

|

|

|

R. Spell (MSL quote), USA

<2006-12-25 00:00>

I read this book after reading Maier's account of working at Cramer's hedge fund, Trading with the Enemy. While Maier's book is not an in-depth detailed book, it projects Cramer as an egotistical tyrannical trader. Reading this book for a comparison, you can believe both sides of the story. Cramer recounts many of the same stories and they are remarkably similar but from different perspectives. For example, they both wrote about the birthday party where Cramer became extremely intoxicated and puked on the guests. Maier describes this as another example of Cramer's poor manners and ego. Cramer describes the bad day he had had and where he was mentally that had him over drink and embarrass his family. If anything, I was surprised that an egomaniac like Cramer could admit to any shortcomings. Many "Masters of the Universe" can't.

Cramer doesn't strike me as a charismatic guy. But you have to be impressed with where he started and where he ended up. Maybe his tactics were questionable. But to compete in the money arena with the fortunes at stake, it is impressive that he was able to even be on the field and favorably compete at least for a few years.

There are two significant relationships in the book I feel compelled to mention. First the investor who Cramer met who not only invested but recommended investors. This also turned out to be the relationship that Maier knew to get his job. A partnership was formed to set up TheStreet.com and somehow in the personnel problems of the venture, Cramer had a falling out with his favored investor that appeared to eventually leading to the shutdown of the hedge fund. You can sense from hearing Cramer's side that there is another side to the story. Cramer doesn't place blame but you can sense that he probably upset many people in his new business venture. It is an interesting case study listening to the different CEOs that are hired and how in Cramer's opinion they ruined the business.

Also, Cramer talks extensively about the relationship with his wife. She was also a stock trader and at different points in his career, she comes back to assist with trading. This part of the book shows just how emotional and psychological trading can be. Cramer would be a tough guy to live with and being married to another trader who understood the environment and the egos involved would make for a volatile relationship. I'd like to know more of the dynamics of that relationship but I suspect she is a real saint, as it appears to work well.

In summary, this book gives some background on what it is like in the rough and tumble world of Wall Street during a very unique trading period. Cramer is a self-promoter who successfully promoted himself into a high profile media job and therefore has some celebrity status. But the real story is the egos of people in this business and what they have to do to be successful and how they can live with some of their egotistical tendencies.

|

|

|

The New Yorker (MSL quote), USA

<2006-12-25 00:00>

Bellicose, self-justifying, coarse, infantile, lovable, and even at times, saintly....He is the greatest public generator of excitement and knowledge about the market today. |

|

|

The Washington Post Book World (MSL quote), USA

<2006-12-25 00:00>

There may be no better glimpse into the workings of Wall Street over the past fifteen years than this one, which can be read with pleasure even by those who don't know a bull from a bear... a riveting memoir. |

|

|

USA Today (MSL quote), USA

<2006-12-25 00:00>

Unflinching, rat-a-tat-tat style... [Cramer's] hair-raising descriptions of Wall Street in the waning days of the bull market are worth the price of admission... a cautionary tale for any small investor tempted by stock market hype and mania. |

|

|

Eugene Gard (MSL quote), USA

<2006-12-25 00:00>

Jim Cramer. The name comes up again and again. Thestreet.com pulses with his rants, CNBC prominently features him, and even sites like the venerable Motley Fool write articles about him. What's the story? Is he a wild hack, or a shrewd investor and advisor?

This book answers some of those questions, and answers a whole lot more. It starts when he graduates from college, and follows him through journalism, law school, and through the investment world, culminating when he hangs up his hedge fund at the peak of success. He didn't get too far from the lifestyle though, as you can tell from his omnipresent, uh, presence.

I didn't like him going in, but the book made me look at him in a new light. There are so many lessons, and so much truth in this book that I have to give it my highest recommendation. Even if you don't agree with Cramer's analysis and investing style, you should read this book! I'm a religious listener to his Real Money podcast, and though it makes Ben Graham roll over in his grave, this guy has done it all, and genuinely wants to help people make money. That's at least partially because I think he wants recognition as a guru - he makes money from thestreet.com, but he doesn't need it. If all he wanted was money, he'd still be at his hedge fund.

If this book teaches nothing else, it proves that the average person sitting at home has no hope of competing with hedge funds as a day trader. They have too much info and control too much money. You have no chance of beating professional (i.e. Wall Street)day traders at their game. Not that there aren't other ways of beating the street- it's just that you are inevitably scooped if you ever think you're making a move on folks when it comes to trading (vs. investing).

And, it's a good story. This book gets the seal of approval. |

|

|

|

1 Total 1 pages 10 items |

|

|

|

|

|

|